- 5 Beds

- 3 Baths

- 10,500 Sqft

- .31 Acres

8716 Ramsgate Avenue

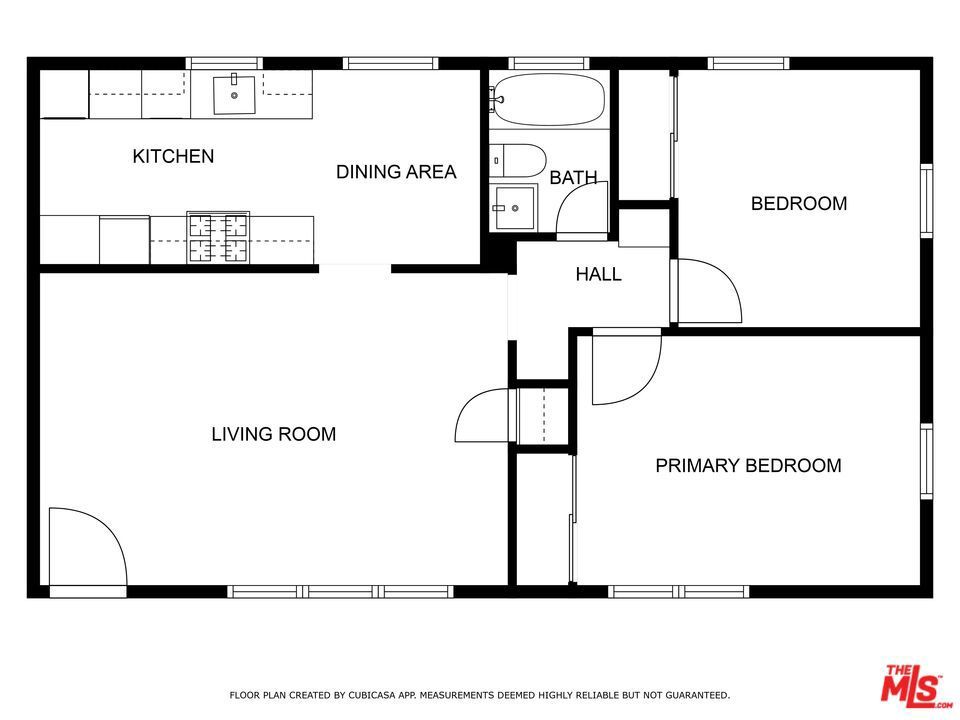

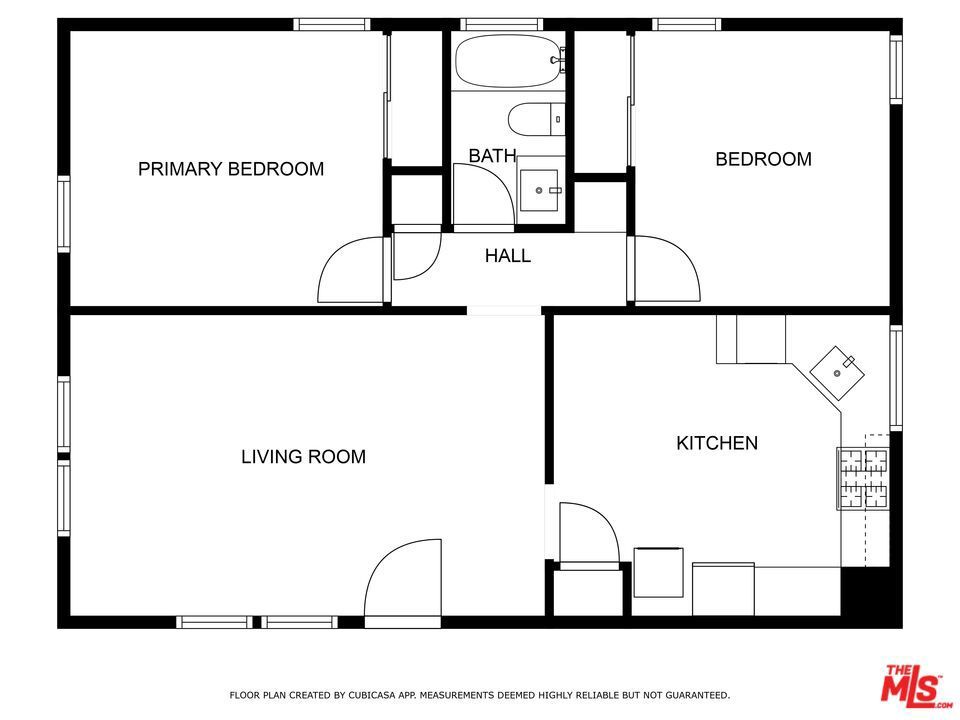

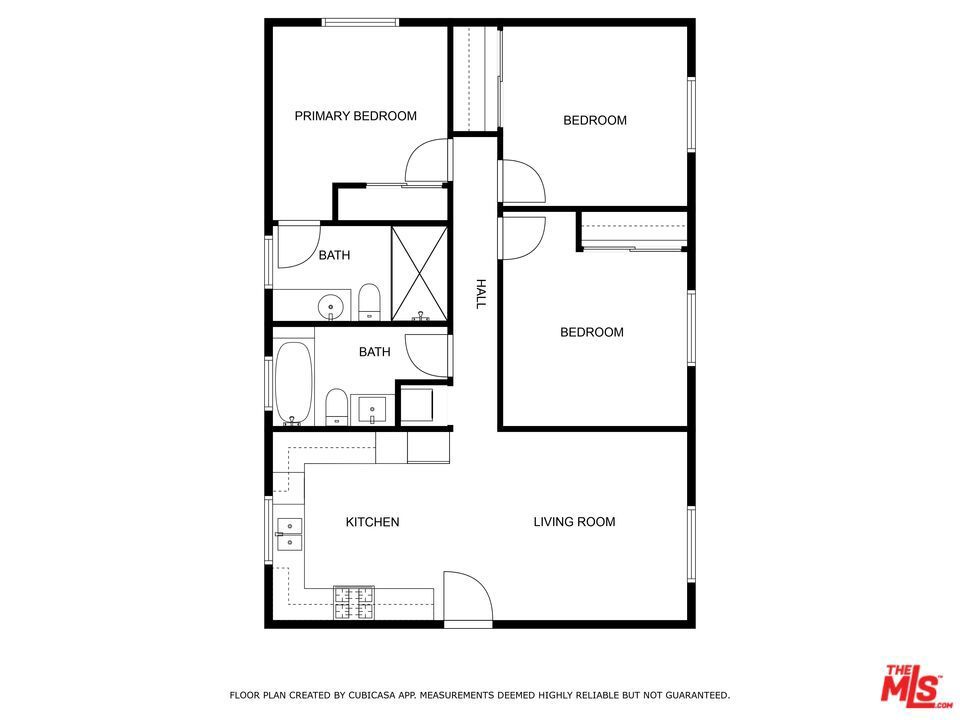

8716 and 8722 Ramsgate Avenue offer a rare Westside Los Angeles multifamily opportunity delivering a true 7.00% cap rate and sub-10 GRM (9.95x) on current in-place income - an exceptionally uncommon pricing profile for a fully rebuilt, turnkey asset in Westchester. The property consists of 12 units across two side-by-side parcels on a double lot, comprehensively redeveloped in 2025, including four newly constructed units. The scope of work was extensive and property-wide, with all major building systems replaced or upgraded, including roof, windows, plumbing, sewer, electrical, HVAC, lighting, and fixtures. The result is a true no-capex acquisition with no deferred maintenance and no near-term capital exposure. The exterior was fully redeveloped as part of the 2025 improvements, featuring new stucco and paint, updated railings and stair systems, modernized building elevations, and professionally designed drought-tolerant landscaping with paver hardscaping throughout the common areas. The property is situated on a quiet, residential, tree-lined Westchester street, reinforcing long-term tenant appeal and pride of ownership. Unit interiors feature high-end finishes throughout, in-unit washers and dryers, and a highly desirable unit mix of eight two-bedroom units and four three-bedroom units. The execution and layout deliver durable, operationally simple, and immediately stabilized income supported by substantive improvements rather than cosmetic upgrades. Located west of the 405, just off Manchester, the property benefits from sustained rental demand driven by proximity to Loyola Marymount University, the Playa Vista employment corridor, and Los Angeles International Airport. The site is also minutes from Playa del Rey and the Inglewood entertainment district anchored by SoFi Stadium, reinforcing deep and diverse renter demand. In a Westside market where renovated assets of similar quality typically trade at materially lower yields, this offering stands apart by delivering meaningful day-one income without renovation risk, lease-up exposure, or speculative assumptions. The combination of exceptional pricing metrics, high-quality redevelopment, and a supply-constrained Westside location makes opportunities like this inherently scarce in today's buyer-driven environment.

Essential Information

- MLS® #26639463

- Price$5,545,000

- Bedrooms5

- Bathrooms3.00

- Square Footage10,500

- Acres0.31

- Year Built1951

- TypeResidential Income

- StatusActive

Community Information

- Address8716 Ramsgate Avenue

- AreaC29 - Westchester

- CityLos Angeles

- CountyLos Angeles

- Zip Code90045

Amenities

- ParkingNone

- GaragesNone

Interior

- # of Stories2

- StoriesMulti/Split

Additional Information

- Date ListedJanuary 16th, 2026

- Days on Market4

- ZoningLAR3

Listing Details

- AgentDon Favia

Office

Realty Investment Advisors, Inc.

Don Favia, Realty Investment Advisors, Inc..

Based on information from California Regional Multiple Listing Service, Inc. as of January 20th, 2026 at 8:30pm PST. This information is for your personal, non-commercial use and may not be used for any purpose other than to identify prospective properties you may be interested in purchasing. Display of MLS data is usually deemed reliable but is NOT guaranteed accurate by the MLS. Buyers are responsible for verifying the accuracy of all information and should investigate the data themselves or retain appropriate professionals. Information from sources other than the Listing Agent may have been included in the MLS data. Unless otherwise specified in writing, Broker/Agent has not and will not verify any information obtained from other sources. The Broker/Agent providing the information contained herein may or may not have been the Listing and/or Selling Agent.